In the world of trading, two prominent strategies dominate: Day Trading and Swing Trading. Both methods offer unique opportunities and challenges, but which one is more profitable in 2025? In this article, we will compare both strategies, their advantages and drawbacks, and help you determine which one aligns better with your goals.

What is Day Trading?

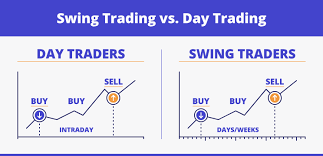

Day trading involves buying and selling financial instruments (such as stocks, forex, or crypto) within the same trading day. The goal of day trading is to profit from short-term price fluctuations by executing multiple trades throughout the day. Day traders typically close all positions before the market closes to avoid overnight risks.

Pros of Day Trading:

- Fast Returns: If executed correctly, day trading offers the potential for quick profits, as traders capitalize on short-term movements.

- No Overnight Risk: Since positions are closed before the end of the trading day, there is no exposure to overnight market changes.

- High Leverage: Many brokers provide high leverage to day traders, which can amplify gains (but also increase risk).

- No Waiting Time: Day traders don’t need to wait for weeks or months for their trades to develop. They can generate profits daily.

Cons of Day Trading:

- Requires Significant Time and Attention: Day trading demands continuous monitoring of the markets, which can be exhausting and time-consuming.

- High Transaction Costs: Frequent trading leads to higher transaction costs, including commissions and fees.

- Stressful: Due to its fast-paced nature, day trading can be stressful, especially when trades don’t go as planned.

What is Swing Trading?

Swing trading, on the other hand, involves holding positions for several days or weeks, aiming to capture price “swings” or trends. Swing traders focus on taking advantage of short- to medium-term trends, and unlike day traders, they do not close all positions by the end of the trading day.

Pros of Swing Trading:

- Less Time-Intensive: Unlike day trading, swing traders don’t have to monitor the markets constantly. They can analyze the charts at the beginning or end of the day.

- Lower Transaction Costs: Fewer trades mean reduced commissions and fees, which can boost overall profitability.

- Longer Market Movements: Swing traders can capture larger market movements compared to day traders, potentially leading to higher profits.

- Less Stressful: Since trades are held for a longer period, there’s less stress over quick, small price changes.

Cons of Swing Trading:

- Exposure to Overnight Risks: Swing traders are exposed to overnight price gaps, which can lead to unforeseen losses.

- Slower Profits: It may take longer to see significant returns compared to the fast-paced profits of day trading.

- Requires Patience: Swing trading demands more patience, as traders need to wait for the right market conditions.

Which Strategy is More Profitable in 2025?

The profitability of day trading versus swing trading depends on several factors:

- Market Volatility: 2025 is expected to see increased market volatility, especially in markets like cryptocurrency and stocks. In such a scenario, day trading might offer more opportunities to capitalize on smaller price movements, potentially increasing short-term profits. However, swing trading can also be highly profitable during volatile periods when price swings are more pronounced.

- Technological Advancements: With the rise of AI-driven trading algorithms and tools, both day trading and swing trading can be automated to a certain extent. In 2025, day traders who utilize advanced algorithms may be able to gain an edge in capturing short-term market movements. Swing traders can also benefit from AI tools that identify longer-term trends more accurately.

- Risk Tolerance and Time Availability: Day trading may be more suitable for those with a high-risk tolerance and the time to dedicate to monitoring markets throughout the day. Swing trading, on the other hand, could be more appealing to individuals with a lower risk tolerance or those who prefer not to be glued to the screen all day. If you’re looking for quicker returns and can handle higher stress levels, day trading might be the better option. For those seeking slower, but potentially more stable returns, swing trading may be preferable.

- Capital Requirements: Day trading typically requires a larger amount of capital due to its leverage and the need to execute multiple trades. Swing trading often requires less capital to get started, as the trades are held longer and there’s less focus on daily market movements.

Final Verdict: Which One is Right for You?

Day Trading might be more profitable if:

- You have the time and dedication to monitor the market throughout the day.

- You thrive under pressure and are comfortable with higher risk.

- You’re able to leverage technology and algorithms for trade execution.

Swing Trading might be more profitable if:

- You prefer a less time-consuming approach and are willing to hold positions for several days or weeks.

- You want to avoid the stress and time demands of day trading.

- You’re looking for less volatility and a slower, more deliberate trading style.

In conclusion, there is no one-size-fits-all answer to which strategy is more profitable. The best approach is to consider your personal trading style, risk tolerance, and the amount of time you can devote to monitoring the markets. Both strategies offer profitable opportunities, but how much you can earn will depend on your understanding of the markets, discipline, and execution of your trading plan.