Position Sizing: How Much to Trade per Order

Position sizing is one of the most critical aspects of trading that often goes overlooked by many traders. It refers to determining the number of units or shares of an asset you will trade in a given position, based on the amount of capital you have and the level of risk you are willing to take on a single trade. Proper position sizing can help protect your portfolio from major losses and increase the probability of long-term success in trading.

In this guide, we will explore the key concepts behind position sizing, how to calculate the optimal position size, and the best strategies for effective risk management.

What is Position Sizing?

Position sizing is the process of deciding how much of a particular asset (such as stocks, options, forex, or commodities) you should buy or sell in any given trade. It is directly tied to your risk management strategy, as it determines how much of your overall capital is allocated to a single trade. Essentially, it controls how much risk you are willing to expose yourself to on each trade.

Proper position sizing ensures that you can survive a losing streak and recover from drawdowns without losing all your capital.

Why is Position Sizing Important?

- Risk Control: Position sizing helps control risk by limiting how much you risk on each trade relative to your total capital.

- Capital Preservation: By limiting risk per trade, you protect your portfolio from significant losses and allow yourself to stay in the game for the long run.

- Maximizing Potential Gains: With proper position sizing, you can optimize your trading returns while managing risk effectively.

- Avoiding Emotional Stress: When you risk too much on a single trade, you can become emotionally distressed, which could lead to poor decision-making and further losses.

The Key Factors That Impact Position Sizing

Before calculating position size, you need to consider several factors that influence how much you should trade on each position.

- Account Size: The total capital in your trading account plays a key role in determining how much to risk on each trade. A larger account allows you to take larger positions with smaller relative risk.

- Risk Tolerance: Risk tolerance is the amount of money you are willing to lose on a trade without affecting your overall capital. It is usually expressed as a percentage of your trading account (e.g., 1% of your total capital).

- Stop Loss Level: The distance between your entry price and stop loss determines how much of your capital is at risk. The wider the stop loss, the smaller the position size should be, and vice versa.

- Volatility: Highly volatile assets (stocks, commodities, forex) require smaller position sizes because the potential for price movement and losses is higher. On the other hand, less volatile assets may allow you to trade larger positions with lower risk.

- Trade Frequency: If you’re trading frequently, you’ll need to adjust your position size to avoid risking too much of your capital on multiple trades.

How to Calculate Position Size

The formula for position sizing is relatively simple and involves the following key variables:

- Account Size: The total amount of capital in your trading account.

- Risk Percentage: The percentage of your account you are willing to risk on a single trade.

- Stop Loss: The distance from your entry price to your stop loss in terms of price or points.

Formula for Position Size

To calculate your position size, use the following formula:Position Size=Account Size×Risk PercentageDollar Risk per Trade\text{Position Size} = \frac{\text{Account Size} \times \text{Risk Percentage}}{\text{Dollar Risk per Trade}}Position Size=Dollar Risk per TradeAccount Size×Risk Percentage

Where:

- Dollar Risk per Trade = (Entry Price – Stop Loss Price) * Contract Size

Example 1: Position Sizing for Stocks

Let’s say you have an account size of $10,000, and you’re willing to risk 1% of your account on a single trade. You also have a stock that you want to buy at $100 per share, and you set a stop loss at $90.

- Risk per Trade: 1% of $10,000 = $100

- Dollar Risk per Trade: $100 (Entry Price – Stop Loss) = $100

- Position Size: Position Size=10,000×0.01100=1 share\text{Position Size} = \frac{10,000 \times 0.01}{100} = 1 \text{ share}Position Size=10010,000×0.01=1 share

In this case, you would buy only 1 share of the stock because your maximum risk per trade is $100, and the price movement between your entry and stop loss is $10 per share.

Example 2: Position Sizing for Forex

Let’s say you’re trading the EUR/USD currency pair with a $50,000 account. You want to risk 2% of your capital on a single trade, and you set your stop loss 50 pips away from your entry.

- Risk per Trade: 2% of $50,000 = $1,000

- Dollar Risk per Trade: 50 pips = $500 per mini lot (for simplicity, assume 1 pip equals $10 for a mini lot)

- Position Size: Position Size=1000500=2 mini lots\text{Position Size} = \frac{1000}{500} = 2 \text{ mini lots}Position Size=5001000=2 mini lots

In this case, you would trade 2 mini lots of EUR/USD to risk $1,000, which is 2% of your account size.

Risk-Reward Ratio and Position Sizing

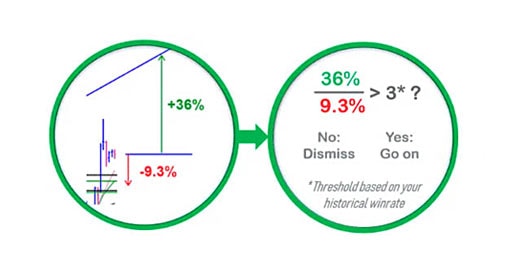

The risk-reward ratio is another key factor in position sizing. It compares the potential loss on a trade (risk) to the potential profit (reward).

- A 1:2 risk-reward ratio means you’re risking $100 to make $200 on a trade.

- The higher the risk-reward ratio, the more you can afford to take larger positions while still maintaining a manageable risk.

If your risk-reward ratio is consistently positive (e.g., 1:3 or better), you may be able to increase your position size. However, if your strategy has a lower success rate, you’ll need to scale back position size to ensure you don’t risk too much.

Best Position Sizing Strategies

1. Fixed Fractional Method

This is one of the most commonly used methods, where you risk a fixed percentage of your account balance on each trade. For example, risking 1% of your capital on each trade.

2. Kelly Criterion

The Kelly Criterion is a more advanced method used to calculate position size based on expected win probability and the ratio of your potential profit to your potential loss. It helps maximize growth while minimizing the risk of bankruptcy.

3. Volatility-Based Position Sizing

In this method, position size is determined by the volatility of the asset you’re trading. Higher volatility means smaller position sizes, while lower volatility assets allow for larger position sizes. Volatility can be measured using indicators like Average True Range (ATR).

Conclusion

Position sizing is a vital component of any successful trading strategy. By carefully calculating and adjusting your position size, you can effectively manage risk and protect your capital from large losses. The key to position sizing is to align it with your risk tolerance, account size, and the specifics of the asset being traded.

Always remember that position sizing is about finding the right balance between risk and reward, and it’s essential to have a plan for every trade. By consistently applying sound position sizing principles, you increase your chances of success in the long run while protecting your trading capital