The balance sheet is one of the core financial statements that traders and investors use to assess a company’s financial health and make informed decisions. Understanding how to read a company’s balance sheet is crucial for making trading decisions, as it provides insights into a company’s assets, liabilities, and shareholders’ equity. In this article, we’ll walk you through how to interpret the key components of a balance sheet and how it can inform your trading strategy.

What is a Balance Sheet?

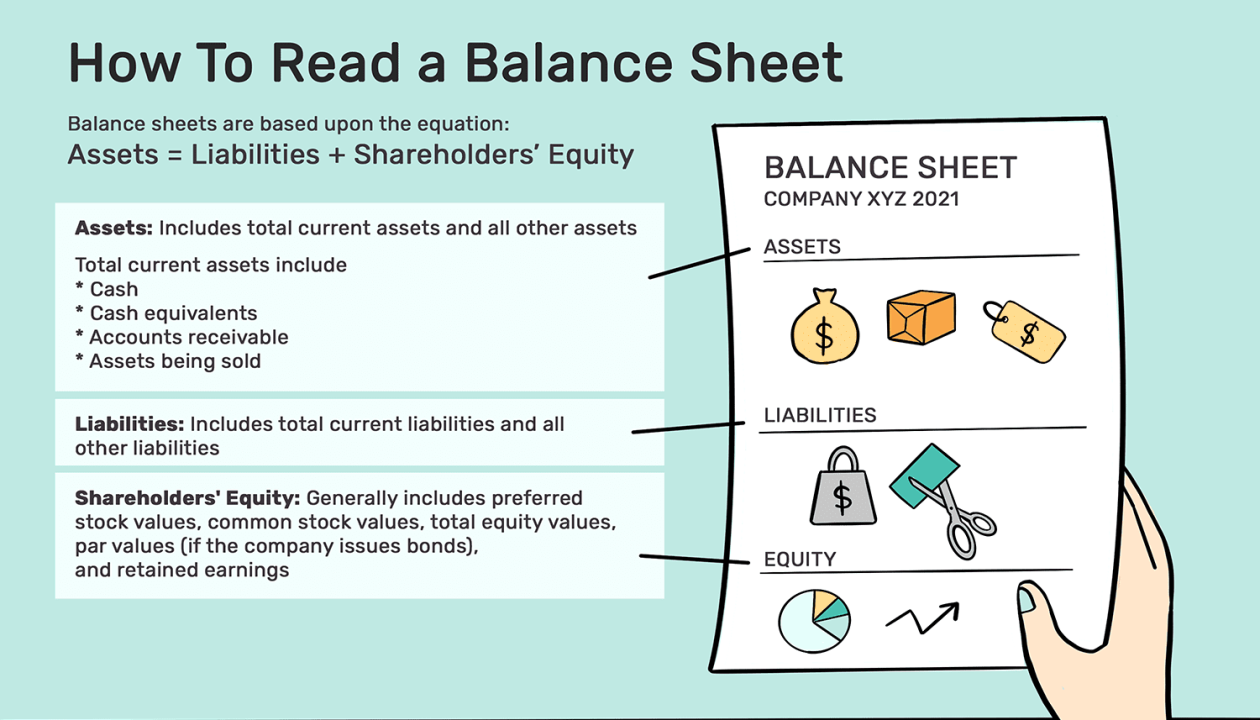

A balance sheet is a financial statement that gives a snapshot of a company’s financial position at a specific point in time. It shows the company’s assets (what it owns), liabilities (what it owes), and equity (the value remaining after liabilities are subtracted from assets). The balance sheet follows the fundamental accounting equation: Assets=Liabilities+Equity\text{Assets} = \text{Liabilities} + \text{Equity}Assets=Liabilities+Equity

This equation shows that everything a company owns (its assets) is either funded by borrowing money (liabilities) or by the shareholders’ investments (equity).

Components of a Balance Sheet

A typical balance sheet is divided into three main sections:

- Assets

- Liabilities

- Shareholders’ Equity

Let’s break down each of these sections to understand what they represent and how they can influence your trading decisions.

1. Assets

Assets are everything that a company owns or controls that can provide future economic benefits. Assets are classified into two categories:

- Current Assets:

- Current assets are assets that are expected to be converted into cash or used up within one year. These are liquid assets that a company can easily use for day-to-day operations.

- Examples include cash, accounts receivable (money owed by customers), inventory, and short-term investments.

- Non-Current Assets:

- Non-current assets, also known as long-term assets, are assets that are expected to provide value over a period longer than one year.

- Examples include property, plant, equipment (PPE), intangible assets like patents, and long-term investments.

Key Metrics to Watch in Assets:

- Cash and Cash Equivalents:

- Cash is critical because it shows a company’s liquidity. A company with a large amount of cash on hand can cover its liabilities and fund operations or expansion easily. However, too much cash may indicate inefficiency in capital allocation.

- Receivables:

- Accounts receivable shows how much money is owed by customers. A large amount of receivables can indicate that the company is making more sales but may have trouble collecting payments, which can impact cash flow.

- Inventory:

- Inventory represents goods the company intends to sell. High levels of inventory could indicate potential overproduction, leading to excess stock that could eventually lead to write-offs if unsold.

2. Liabilities

Liabilities are obligations that the company owes to external parties and are divided into two main categories:

- Current Liabilities:

- These are debts and obligations that the company needs to settle within one year. This includes short-term loans, accounts payable (money owed to suppliers), and other short-term obligations.

- Non-Current Liabilities:

- These are long-term debts and obligations that are due after one year. They include long-term loans, bonds payable, and pension liabilities.

Key Metrics to Watch in Liabilities:

- Debt-to-Equity Ratio:

- The debt-to-equity ratio measures the relative proportion of debt and equity used to finance a company’s assets. A higher debt-to-equity ratio suggests that a company is heavily reliant on borrowing, which can be risky if the company struggles to generate sufficient income to cover its debts.

- Accounts Payable:

- Accounts payable refers to money owed to suppliers. A significant increase in accounts payable could indicate financial distress or poor cash flow management.

3. Shareholders’ Equity

Shareholders’ equity represents the residual interest in the company’s assets after liabilities are deducted. It is the ownership value that belongs to the shareholders. The key components of equity include:

- Common Stock:

- Represents the amount raised from the issuance of shares.

- Retained Earnings:

- This is the portion of the company’s profits that have been reinvested in the business rather than paid out as dividends. Retained earnings grow over time as the company retains more profits.

- Additional Paid-in Capital:

- This refers to the amount shareholders paid for shares above their nominal value.

- Treasury Stock:

- If a company buys back its own shares, it becomes treasury stock, reducing shareholders’ equity.

Key Metrics to Watch in Equity:

- Return on Equity (ROE):

- ROE measures how effectively a company uses its equity to generate profits. A higher ROE generally suggests better management and profitability.

- Retained Earnings:

- A company with growing retained earnings is likely reinvesting in its operations for future growth. This could indicate long-term stability, especially if earnings are consistently reinvested.

How to Use the Balance Sheet for Trading

Now that we understand the components of a balance sheet, let’s discuss how to use this information to inform your trading decisions.

1. Assessing Financial Health

A healthy balance sheet indicates that a company is in a good position to generate sustainable profits, meet its obligations, and fund future growth. Key factors to assess include:

- Liquidity:

- Check if the company has enough current assets (like cash and receivables) to cover its current liabilities. A quick ratio or current ratio (current assets divided by current liabilities) can help assess this.

- Solvency:

- Examine the company’s long-term debt and debt-to-equity ratio to ensure that the company isn’t overly reliant on debt. A high level of debt could make the company vulnerable in tough economic conditions.

2. Profitability and Efficiency

Profitability ratios like return on equity (ROE) and return on assets (ROA) can help gauge the efficiency with which the company generates profits. Strong profitability indicates that the company is effectively using its assets and equity to produce earnings, which is favorable for long-term growth.

3. Comparing with Peers

It’s crucial to compare a company’s balance sheet with its competitors and industry standards. A company with a stronger balance sheet relative to its competitors may have a competitive advantage and be better positioned for growth, making it an attractive trading opportunity.

4. Evaluating Growth Potential

A company with growing retained earnings or strong investment in long-term assets (like new equipment, R&D, or acquisitions) might be on track for future expansion. Such growth can lead to higher future earnings and stock price appreciation.

Red Flags to Watch For

- High Levels of Debt:

- While debt can be a useful tool for expansion, excessive debt can be dangerous. If a company has a high debt-to-equity ratio, it could be at risk during economic downturns.

- Negative Shareholders’ Equity:

- If a company has negative equity, it means its liabilities exceed its assets, signaling financial distress. This is a serious red flag for investors.

- Declining Retained Earnings:

- A consistent decline in retained earnings might suggest the company is facing challenges in generating profits or reinvesting them in the business.

Conclusion

The balance sheet is a powerful tool for assessing a company’s financial health, liquidity, and overall stability. By understanding how to interpret the key components of the balance sheet, you can make more informed trading decisions. Look for companies with strong liquidity, manageable debt levels, and consistent profitability to identify solid investment opportunities. Additionally, always compare a company’s balance sheet with industry peers and use it in conjunction with other financial statements for a more comprehensive analysis.