Price action trading ek technique hai jo traders ko market ki price movements ko directly observe karne aur unhi movements ke basis par decisions lene ki permission deti hai. Is approach mein, technical indicators ka use nahi hota; instead, traders market ki raw price data (candlestick patterns, support-resistance levels, etc.) ko dekh kar apne trades ko decide karte hain. Iska primary focus market ki actual price movement par hota hai, jo aapko market ke behavior ko samajhne mein madad karta hai.

Price action trading ko samajhne ke liye, sabse pehle aapko yeh samajhna hoga ki price movement ek emotional response hota hai jo buyers aur sellers ke beech ki interaction ko dikhata hai. Har bar jab price change hota hai, to usme market participants ki decision-making, fear, greed, aur other psychological factors involved hote hain.

Key Components of Price Action Trading

- Candlestick Patterns: Candlestick charts ko price action trading mein use kiya jata hai, jo har candlestick ek specific time period mein price movement ko represent karta hai. Popular candlestick patterns, jaise Doji, Engulfing, aur Pin Bars, traders ko important signals dete hain regarding trend reversals aur market sentiment.

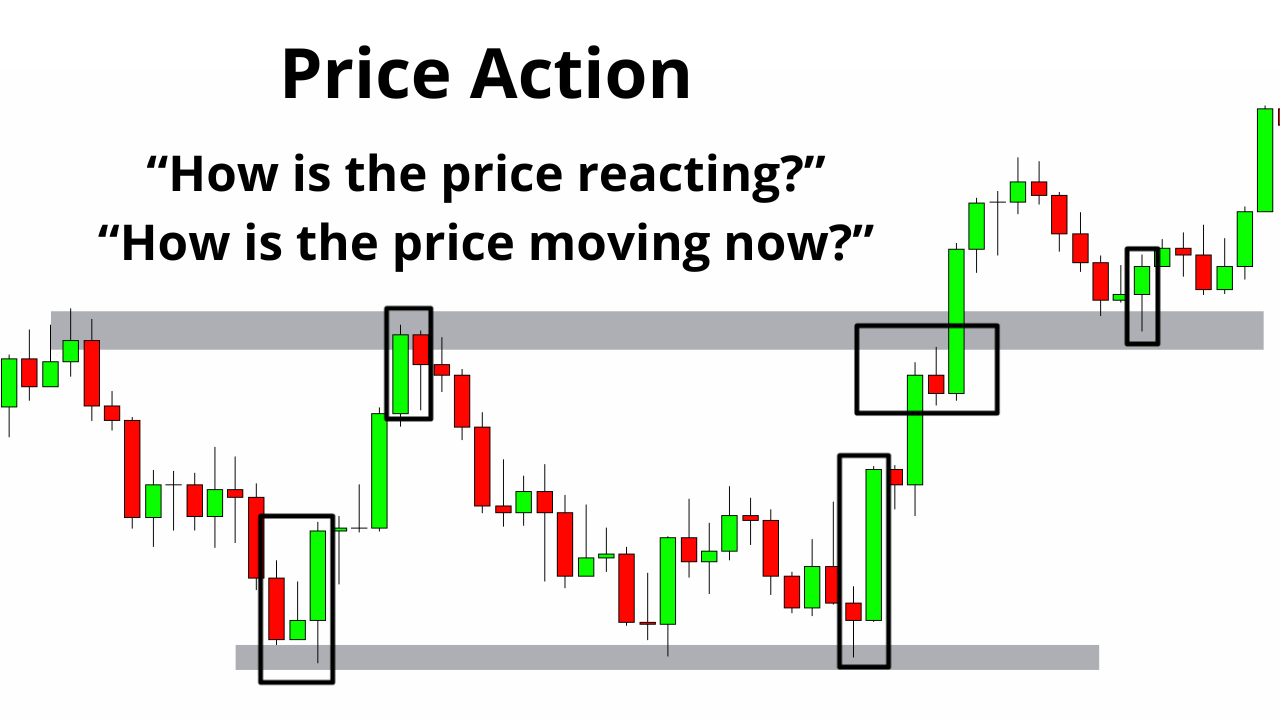

- Support and Resistance Levels: Support level wo price point hai jahan price neeche jane ke baad wapas uthne ki koshish karta hai, aur resistance level wo point hai jahan price upar jane ke baad ruk jaata hai. Ye levels price action trading mein important hain, kyunki ye aapko indicate karte hain ki market kaha reverse ho sakta hai.

- Trend Lines: Trend lines ko draw karte waqt, aap market ke dominant trend ko observe karte hain. Agar price consistently higher highs aur higher lows bana raha hai, to market uptrend mein hai. Agar price lower lows aur lower highs bana raha hai, to market downtrend mein hai. Price action trading mein trend lines ka use market ke direction ko samajhne ke liye hota hai.

- Breakouts and Pullbacks: Jab price support ya resistance levels ko break karta hai, to usse breakout kaha jata hai. Traders breakout ke baad price ke movement ko follow karte hain. Pullback ek short-term reversal hota hai, jo ek trend ke continuation ke liye hota hai. Pullbacks ko identify karna price action trading mein ek important skill hai.

How to Use Price Action Trading

- Identify the Trend: Sabse pehle aapko market ka trend identify karna hota hai. Kya market bullish (uptrend) hai ya bearish (downtrend)? Iske liye aap trend lines, moving averages, aur other price action signals ka use kar sakte hain.

- Look for Key Patterns: Candlestick patterns ko dekh kar aap trend reversals ya continuation signals identify kar sakte hain. For example, agar aapko Engulfing Pattern dikhe jo previous downtrend ke baad aata hai, to yeh bullish reversal signal ho sakta hai.

- Wait for Confirmation: Price action trading mein, confirmation zaroori hota hai. Aapko koi bhi trade enter karne se pehle confirm hone ka wait karna chahiye. Ye confirmation aap price ke action, support/resistance levels, ya candlestick patterns se le sakte hain.

- Manage Risk: Price action trading mein risk management bahut zaroori hai. Aapko apni trades ko stop-loss orders ke saath protect karna hota hai. Yeh ensure karta hai ki aapki losses controlled rahen, aur aap apne capital ko preserve kar sakein.

- Practice Patience: Price action trading mein patience zaroori hai. Kabhi kabhi aapko long periods tak price movement ka wait karna padta hai. Agar market aapke favorable conditions ke bina move kar raha hai, to patience rakhein aur apne trades ko enter na karein jab tak aapko proper signal na mile.

Advantages of Price Action Trading

- No Need for Indicators: Price action trading mein aapko kisi technical indicator ki zaroorat nahi hoti. Yeh ek pure, raw approach hai jo market ki actual price movement ko observe karta hai.

- Clear Signals: Candlestick patterns aur price levels traders ko clear aur precise signals dete hain jo easy to understand hote hain.

- Adaptable to Any Market: Price action trading ko aap kisi bhi market mein use kar sakte hain, chahe aap stocks, forex, commodities, ya cryptocurrencies trade kar rahe ho.

- Better for Short-Term Trading: Short-term traders, jaise day traders aur swing traders, price action trading ko bahut effectively use karte hain, kyunki isme price movements ka jaldi response milta hai.

Challenges of Price Action Trading

- Requires Experience: Price action trading ko sahi tarike se seekhna time-consuming ho sakta hai. Aapko market ka behavior aur price movements ko achhe se samajhna padta hai.

- Subjectivity: Price action trading mein, aapko apni interpretations kaafi baar khud karni padti hai, jo kabhi kabhi subjective ho sakti hain. Ye decisions emotional biases se bhi influence ho sakte hain.

- No Guarantees: Price action trading koi foolproof method nahi hai. Market volatility aur unpredictable events ke wajah se kabhi kabhi price action signals galat bhi ho sakte hain.

Conclusion

Price action trading ek effective aur powerful method hai jo traders ko market ke natural price movements ko samajhne aur unhi movements ko leverage karne mein madad karta hai. Agar aap price action trading ko seekh lete hain, to aapko market ki true direction ka pata chal sakta hai aur aap better trading decisions le sakte hain. Lekin, is approach mein practice, patience aur risk management kaafi important hote hain. Price action trading ko apni strategy mein integrate kar ke aap apni trading ko next level tak le ja sakte hain.